Churn: Definition, How to Calculate Churn Rate, Tips to Reduce Churn

Churn rate can be a sneaky metric. While sales managers and reps focus on the “big” KPIs — revenue, win rate, and customer acquisition cost — excessive churn can easily erase gains in otherwise productive areas of your sales pipeline if you’re not careful.

Churn refers to the number of customers who discontinue using your product during a certain time period. Much like sleeping on an air mattress with a slow leak, unaddressed churn can wreak havoc on your business goals before you even realize there’s a problem.

That’s why it’s important for sales teams to understand what constitutes churn, how to calculate their churn rate, and what factors play into the process. In this article, we’ll go over all of that and more.

Here’s what we’ll cover:

- What is the Definition of Churn?

- Why Does Customer Churn Matter?

- What is Churn Rate?

- How to Calculate Churn Rate

- How to Track Churn Rate

- What is a Good Churn Rate?

- Other Metrics that Impact Churn Rate

- Tips to Reduce Customer Churn

What is the Definition of Churn?

Churn refers to the scenario in which a paying customer stops using a product or service and discontinues future payments.

Churn — sometimes also called “attrition” — occurs when the customer cancels their subscription or account and expresses the desire to no longer pay for your offering.

It’s usually expressed as the rate of customers who leave, but can also sometimes refer to the amount of revenue lost as a result of that subset of lost customers.

Churn rate is always measured over a given period of time. We’ll dive further into the specifics of the formula later on in this article.

Why Does Customer Churn Matter?

Churn rate is an especially important metric for SaaS and other subscription-based companies. Acquiring new subscribers is anywhere from 5 – 25x more expensive than maintaining existing ones, so it’s crucial that businesses avoid churn however possible.

Furthermore, sellers have a 60 – 70% chance of cross-selling and upselling to existing customers. Compare that to their only 5 – 10% chance of closing a sale with a new customer, and it’s clear why a low churn rate and an eye toward customer retention are critical to the success of any organization.  Marketing, sales, and customer success need to have an all-hands-on-deck approach to attracting and retaining highly qualified buyers that are likely to derive long-term value from your product.

Marketing, sales, and customer success need to have an all-hands-on-deck approach to attracting and retaining highly qualified buyers that are likely to derive long-term value from your product.

It’s worth repeating that churn can be sneaky. Even a few percentage points dramatically affect how detrimental churn will be on a company’s bottom line. Take a look at the example below, highlighting the various costs associated with each a 4% and a 10% customer churn rate.

Beyond the obvious impacts to your customer lifetime value and overall bottom line, an excessive number of churned customers may indicate any number of glitches in the buyer’s journey or onboarding process.

Measurable End Result

Churn is a lagging indicator, meaning that it’s the measurable end result derived from measurable strategic activities that came before it.

In other words, measuring churn is helpful in determining whether or not a problem exists, but may not tell you exactly what the problem really is. Sales, marketing, and customer satisfaction will need to collaborate in order to determine where the pipeline hits snags that create churn — we’ll touch on some specific ones later on in this article.

Whenever you see your churn rate start to creep up, it should signal to your team that there’s an issue brewing that needs to be investigated immediately.

What is Churn Rate?

Churn rate — also sometimes known as attrition rate — refers to the percentage of customers that cancel or choose not to renew their subscription in a given time period.

Churn rate is usually analyzed over the course of a month, quarter, or year.

Churn rate is a very important metric, especially for SaaS and other subscription-based companies.

Churn rate is an important metric all on its own; more customers are better than fewer for just about every business that wants to make money. But churn rate should also be analyzed in the context of customer acquisition cost (CAC). If customers are churning before a business can recoup the cost of acquiring them, the business will not be profitable.

How to Calculate Churn Rate

Calculating churn rate — also sometimes called “churn modeling” — is actually pretty straightforward.

The most basic formula divides the number of customers who left a company during a specific time frame by the total number of customers there was at the beginning of that period.

Here’s that formula in visual form: In reality, though, in order for this metric to offer any kind of actionable insight, you’ll need to consider a few additional factors.

In reality, though, in order for this metric to offer any kind of actionable insight, you’ll need to consider a few additional factors.

To start, most businesses will have customers coming in at the same time that customers are churning out. Your churn model should account for the accounts you’ve added.

Here’s what that variation would look like for a monthly churn model: Your team may also want to view churn in terms of lost revenue. In this case, it’s similarly important to differentiate between gross revenue churn and net revenue churn.

Your team may also want to view churn in terms of lost revenue. In this case, it’s similarly important to differentiate between gross revenue churn and net revenue churn.

Gross & Net MRR Churn Rate

Gross monthly recurring revenue (MMR) churn refers to revenue lost due to customer cancellation during a given time period.

Net revenue churn calculates this same lost revenue but then adds back in the additional revenue generated from new customers during that period.

Sales organizations that are interested in using churn modeling to their advantage should consider calculating the metric by cohort.

You can calculate churn rate for virtually limitless subsets of buyers — called cohorts — to determine granular-level behavioral indicators that can improve your pipeline.

Try experimenting with any number of data manipulations — January 2018 Buyers, All-Time January Buyers, Buyers Who Downloaded Whitepaper A, Buyers Who Needed More Than 3 Follow-Ups, and so on. These kinds of cohort analyses will help you pinpoint what part of your pipeline needs the most attention.

How to Track Churn Rate

Churn rate is most telling when it’s tracked over time. Churn rate for a single month or quarter may not give you a complete or accurate picture of your customer’s decision to end their business relationship with you.

Fortunately, there are many capable tools that can help you track churn rate.

Many CRM systems can track and store data points around customer churn rate. This can be extremely helpful for sales reps, as the CRM should also hold data regarding all of the customer touchpoints and product interactions up until the point of churn. The CRM can give a timeline-oriented snapshot of the customer’s journey that resulted in churn.

You can also track churn rate with a simple spreadsheet. This method can be as simple or as complicated as you want it to be. For some teams, it may be enough to simply track churn rate in the sheet and monitor it over time.

Other teams that need more sophisticated data analysis should look into whether their spreadsheet program has a built-in data visualization tool. Tools like this can help synthesize the data in an easy-to-read graphical format.

Sales teams can also look into using sales dashboard software to track churn rate. Sales dashboards can be particularly useful because they can track and depict data over several categories at once.

You could, for example, use a sales dashboard to analyze churn rate against CAC over a given period of time.

Tip: Do you have all the tools you need to lock down your best-fit customers and ensure they’re happy? Grab a free blueprint below that consists of successful business tech stacks and tips.

The Optimal Technology Stack for B2B Sales TeamsUsing data from the most successful business-scaling models, we designed a blueprint for the exact technology your business needs at each phase of growth.

The Optimal Technology Stack for B2B Sales TeamsUsing data from the most successful business-scaling models, we designed a blueprint for the exact technology your business needs at each phase of growth.

What is a Good Churn Rate?

A “good” churn rate — that is, a churn rate low enough that it won’t have major detrimental effects on your business — is hard to pinpoint. Healthy churn rates are defined by industry and market, and there’s some variety in what’s acceptable across these.

Of course, the lower the churn, the better — that’s true across industries. The less churn you have, the more customers you retain and from whom you generate profit.

That being said, a churn rate that’s between 2% – 8% for B2C SaaS customers, and 2% or below for B2B SaaS customers is generally considered good.

For all types of businesses, a 10% churn rate is a red-alarm benchmark. A churn rate of 10% or more spells major existing or upcoming financial woes.

Other Metrics that Impact Churn Rate

A faltering churn rate is kind of like a check engine light: it means there’s something going on under the hood of your sales process that needs a closer look.

A bad churn rate can mean any number of things. It may indicate that your marketing campaigns are attracting poor fits from the get-go, making customers more likely to unsubscribe when they realize the product doesn’t meet their needs.

It could also mean that your pricing strategy relative to your value offering is misaligned.

Customer success represents yet another potential problem area. Poor onboarding is a huge factor in customer churn and should be one of the first places you look when you see the rate start to climb.

Here are some metrics to consider when your churn rate indicates a problem.

Negative Onboarding Experience

Studies show that 40% – 60% of churn happens after the customer uses the product only once. This should ring alarm bells for sales and customer success teams everywhere.

It’s imperative that the full scope of product value and functionality is delivered through the selling and onboarding process. If your customers are confused about how to use your product to ease their pain points, they’re not likely to stick with it for long. It’s up to you to hold their hand until they’re confident in leveraging your solution.

Poor Customer Service

According to ZenDesk, 82% of existing customers churn because of bad customer service. A good customer experience is essential for ensuring repeat business.

If your sales reps remain in close contact throughout the sales process, only to disappear once a contract is signed, you’re at risk of losing otherwise good-fit customers. Remember, buyers want to feel like service providers care about their needs — continue to follow up even after the deal is done as a gesture of good faith.

Poor Customer-Product Fit

A high churn rate can indicate issues at the top of the funnel. If, for example, your lead generation strategies attract only subpar customer matches for your product, you’re more likely to lose customers quickly after they purchase once they realize they won’t get what they really need.

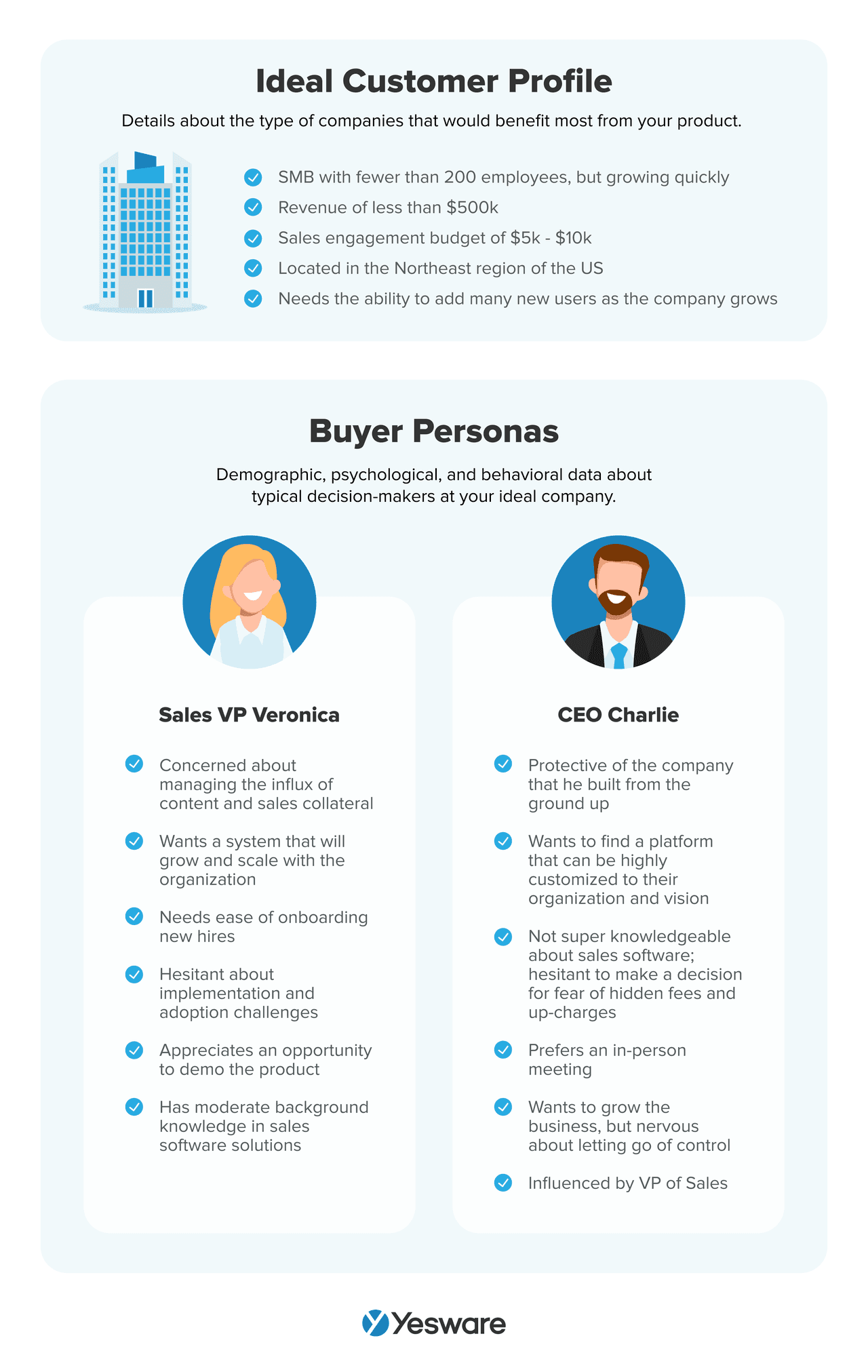

If this sounds like a challenge your salesforce needs to address, consider developing an ideal customer profile (ICP) and buyer personas.  These profiles will help your sales and marketing teams fill the pipeline with high-quality leads and likely reduce your churn rate.

These profiles will help your sales and marketing teams fill the pipeline with high-quality leads and likely reduce your churn rate.

Involuntary Churn

Sometimes customers churn not by their own choice. This is called involuntary churn, and can indicate issues with your billing process.

If you’re certain the rest of your pipeline has been optimized, and you see no other reason why you might be losing customers soon after signing them, you may want to reconsider your payment and billing practices.

Lack of Engagement

Sometimes salespeople use the wrong content at the wrong time. Customers may churn because they believe they made an impulsive purchase — which means the salesperson didn’t do a good enough job of engaging them throughout the sales process.

Take a closer look at the content available to your salespeople, and how well it resonates with particular buyers. You can reverse-engineer this exercise by analyzing which content was most popular with your most successful existing customer base.

A sales engagement tool like Yesware can also help with this process.

Tips to Reduce Customer Churn

If your customer churn is too high, the following tips can help you improve your customer retention.

Get to the Why (And the When)

Perhaps the most effective way to decrease customer churn is to develop a thorough understanding of why it happens.

Sales teams can interview or survey ex-customers to better understand why they decided to leave.

Sales teams can also use data to help them analyze when churn is most likely to happen. These insights can help salespeople strategically preempt churn triggers.

If pinpointing the “why” proves challenging or time-consuming, there are additional measures a sales team can take in the meantime to address churn. CRM data, for example, can be a wonderful place to gain insights into behavior that indicates imminent churn.

For example, you might find that the rate of attrition goes way up for customers who haven’t logged into their accounts in 21 days. If that’s the case, you can have sales or customer success teams strategically check in with customers if they haven’t logged in for two weeks.

You might also note that new customers who delay setting up their new accounts by more than five days are highly likely to churn. To mitigate this issue and prevent further churn, you could create educational campaigns for new customers through blog sharing, interactive onboarding, or email drip series that explain how to set up the new account and navigate the tool’s features.

Educate and Train

Some companies find that their high churn rate is ultimately due to subpar performance from any combination of the sales, marketing, and customer success teams.

Sales reps need to be approaching the sales process through a framework of providing value. If customers don’t feel that their post-purchase experience aligns with what they were promised during the sales process, they may churn.

Alternatively, if the customer success team is not prepared to resolve a wide variety of issues, customers may also become disillusioned with your product or service and look for opportunities to churn out.

Make sure that each of your customer-adjacent teams are well-trained and follow best practices for attracting and retaining customers.

Refine Your ICP and Buyer Personas

If you find that many customers are churning after purchase, it could be that the top section of your sales funnel is not optimized. While some subpar leads may eventually become closed-won deals, they will soon discover that the product is not a good fit and, in the end, churn.

To address this potential issue, sales and marketing should collaborate to create or further refine the ideal customer profile (ICP) and buyer personas. Your offer should speak directly to the needs of the customer segments that you’re targeting.

Think Outside the Box

Sometimes, reversing a high churn rate can be a slow process. It might require a combination of strategies and iterations before you begin to see the effects of your efforts.

You can boost your own efforts and possibly reduce churn with a couple of churn rate “hacks.” These aren’t the right fit for every company, so be sure to discuss any strategy changes with your sales manager before executing them. But for some teams, these small actions can have a noticeable impact on your churn rate.

First, you might consider implementing a loyalty or rewards program for customers who maintain/renew their contracts. Nearly 85% of customers report that they’re more likely to stick with a brand that offers a loyalty program, and studies show that loyalty programs can generate up to 20% of a company’s profits.

You can also think about leveraging feedback from users enlisted in a free trial. Demos and free trials are as helpful for salespeople as they are for prospective customers. Kill two birds with one stone by offering a free trial to a hot lead in exchange for their candid feedback on your offer/product.

This isn’t necessarily more effective than any of the other strategies outlined here, but the fact that it’s “free” feedback, and likely impartial, makes it worth it.

Do you know your company’s current churn rate? What steps can you take today to start to bring it down? You’d be surprised at how a few small tweaks can start to move churn rate in a more positive direction — try one of the strategies outlined in this article today to start seeing improvements.

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Anya Vitko

Sales, deal management, and communication tips for your inbox