Dynamic Pricing: What It Is & How to Implement

Casey O'Connor

Dynamic pricing is a pricing strategy in which businesses adapt the price of their offerings according to various external factors, most of which are usually explained by supply and demand.

Historically, dynamic pricing has been used sparingly due to how complex it can be, but it’s becoming more popular as technology is making decision-making around pricing rules and the process of implementing them easier.

Sales and marketing teams might potentially opt for dynamic pricing in any number of scenarios because it can maximize profits across markets and sales timelines when implemented correctly.

In this article, we’ll go over everything you need to know about dynamic pricing, including more details about how it works, why it can be beneficial, how to implement the system, and a few examples.

Here’s what we’ll cover:

- What Is Dynamic Pricing?

- Types of Dynamic Pricing

- Dynamic Pricing Examples

- Pros and Cons of Dynamic Pricing

- How to Implement a Dynamic Pricing Strategy

What Is Dynamic Pricing?

Dynamic pricing — also known as surge pricing, demand pricing, time-based pricing, or real-time pricing — is a pricing model in which the cost of an offering goes up or down according to a variety of factors, such as supply, demand, market trends or disruptions, and competitor strategy.

Sales and marketing teams use dynamic pricing in order to maximize their profits.

In theory, this pricing strategy should allow teams to capture as many customers as possible who are willing and able to pay premium pricing, while also scooping up customers during low-demand times who may only be prepared to pay a lower cost.

Dynamic pricing may sound complicated, but the basic principle is actually relatively simple and has been in use for centuries.

Grocery stores, for example, regularly use dynamic pricing; strawberries are much cheaper when they’re in season than during the cold winter months.

Hotels and airlines use surge pricing, too; reservations become more expensive during popular travel times.

The rise of sophisticated sales technology has made dynamic pricing more affordable, accessible, and simple for sales and marketing teams to access. It is subsequently becoming more popular.

Sales teams today can use forecasting and accounting software to help them make sophisticated pricing rules with very little effort, which can help them maximize profit during times of variable market demand and other factors.

Types of Dynamic Pricing

Although all dynamic pricing follows the same basic principle — the cost of the offer changes depending on specific factors — there are actually several different models that may work for your team.

Here are a few of the most common types of dynamic pricing.

1. Time-Based Pricing

Time-based pricing is dynamic pricing that sets rules according to particular times. This pricing strategy is often used to encourage customers to make fast purchasing decisions.

Industries like ride-sharing (Lyft and Uber) and delivery services use time-based pricing to capitalize on profit potential during high-demand times. Uber and Lyft charge more during rush hour and other times when it’s hard to get from Point A to Point B.

Restaurants may charge a higher delivery fee during the Superbowl or other “big nights in.”

Airlines also use time-based pricing across a variety of circumstances. On popular flights, for example, you’ll likely pay more the longer you wait to purchase. For flights that are unlikely to book up, on the other hand, you might score a cheap ticket if you wait until the last minute, because the airline is simply happy to offload a ticket instead of letting an unpaid seat go empty because it was too expensive for an impulse purchase.

There are also relevant use cases for time-based pricing in retail sales; sellers may put certain products or collections on sale once new versions are released. This is another example of pricing based on timing.

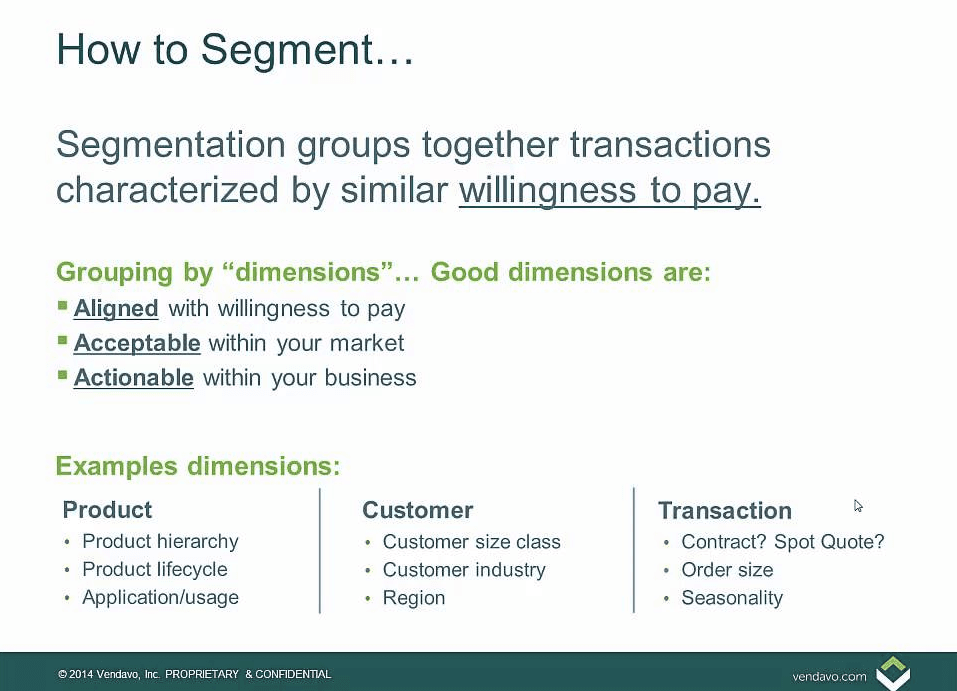

2. Segmented Pricing

With segmented pricing, sales and marketing teams establish two or more price points for similar or even identical offers.

Segmented pricing is also sometimes known as psychological pricing or price discrimination. It’s based on the buyer’s perception of an offer’s value.

One example of segmented pricing is the way airlines market business class seats versus economy class seats. The offers are similar, though not identical, but pricing is based on the traveler’s perceived value of flying business vs. economy class.

Another good example of segmented pricing is event seating. Event venues charge different prices for seats in different sections of the park. Again, the pricing is based on how much different segments of buyers are willing to pay for different event experiences.

For segmented pricing to be effective, your market needs to consist of distinct subgroups, some of whom are willing and able to pay more for an enhanced experience or product.

This isn’t the case for every target audience, so make sure you know your ideal customer profile and buyer personas very well.

3. Peak Pricing

Peak pricing is used when sales teams can reliably benefit from charging higher prices during high-demand times of the year.

Peak pricing strategies are often used in the transportation and hospitality industries.

Theme parks and resorts, for example, often charge higher rates during holidays and common school breaks because they know more people will be traveling.

4. Penetration Pricing

Penetration pricing can be very effective in helping a new organization break into an existing market or increase their visibility in a very competitive one.

With a penetration pricing strategy, sales teams sell their product at a much lower price than their competitors. This can help pull some market share away from established competition.

Penetration pricing can be very effective, but usually only for a short period of time. It’s simply not a sustainable pricing strategy for the long term.

5. Market Conditions

Some dynamic pricing doesn’t follow hard-and-fast rules based on time or market segments. Some markets are volatile enough that sales and marketing teams need to be ready to adapt their pricing strategies very quickly and with careful precision to ensure continued profitability.

The lumber industry is a great example of one in which market conditions can greatly impact pricing on a monthly or even weekly basis. When there’s a shortage of even one type of wood, it causes far-reaching and long-lasting ripples in the rest of the industry’s supply chain. Lumber prices, therefore, are constantly fluctuating and are entirely market-dependent.

Even some unexpected products can be surprisingly affected by market conditions. Think back to March 2020 — hand sanitizer and toilet paper were in desperately high demand, and prices on the free market reflected that. Of course, regulations were soon put in place that protected consumers from outrageous price gouging, but the point here is that supply and demand can actually affect pricing on even the most everyday items.

Dynamic Pricing Examples

Here are a few more examples of real-world examples of dynamic pricing strategies.

Public Transportation

Some cities and towns use dynamic pricing to set the cost of their public transportation system. The DC Metro system, for example, for decades used surge pricing at peak times, during which they charged commuters at rush hour a higher fee to ride the trains.

The DC area also uses a type of dynamic pricing for their “Express Lanes,” a system that allows car commuters to use their EZ-Pass to pay to access faster lanes. The price to use these lanes goes up as traffic increases; conversely, the lanes are cheaper to use during times of less congestion.

Utility Providers

Many utility providers like gas and electric companies use dynamic pricing to meet consumer demand for their products.

For example, some electric companies in cooler climates charge less for electricity in the summer because there’s less demand for it.

In some areas, some electric companies even adapt their pricing continuously throughout the day and electricity may get more expensive when the demand on the grid becomes tenuously high. In fact, some companies in places with excessive heat, like Arizona or Texas, will actually pay you to not use electricity during certain surge hours.

Leisure

The leisure and events industry relies heavily on dynamic pricing strategies.

Entertainment events will adapt the price of their tickets according to event location, seating location with the particular stadium, the time of day of the show, and more.

They may also use segmented dynamic pricing to offer discounts to senior citizens, teachers, or veterans.

Travel & Hospitality

The travel/hospitality industry is another one in which dynamic pricing is widely used. Airlines, hotels, and other travel-related markets all adapt their prices according to a variety of dynamic factors.

Hotels in New England charge higher rates during the fall, when leaf-peepers flock to see the trees; lodging fares in the Caribbean go down during the summer, when it’s quite hot and northerners are less likely to be looking to escape the cold winter months.

E-commerce

E-commerce retail platforms also use dynamic pricing when they put things on sale based on seasonal trends or availability. Summer clothes are in lower demand during winter months, so retailers will mark their prices down in the hopes of enticing more customers to purchase off-season clothing.

SaaS

Even software services can take advantage of surge pricing with the right market and creativity.

Google Ads, for example, sets the price of advertising for specific keywords based on how in demand each word is at any given time.

Sales software with pricing capabilities can make easy work of this sophisticated task.

Pros and Cons of Dynamic Pricing

Many organizations are surprised to learn how affordable and accessible dynamic pricing strategies can be. Even industries that don’t seem to lend themselves to surge pricing can find creative ways to use some of the different models.

That being said, just because it’s more readily available for adoption doesn’t mean it’s the right fit for every team or every scenario. Here are the pros and cons of dynamic pricing that your team should consider before implementing the strategy.

Pros

There are many reasons why dynamic pricing might be a lucrative option for your team.

- It helps your business maximize profitability.

- It enables you to pay your employees more (which is especially meaningful if they’re meeting higher demand that’s enabling you to charge more).

- It broadens your market to include subgroups who may pay more or less than your average ICP.

- It increases close rates, profitability, and revenue.

- It enables you to get to know your customer better, thereby improving customer satisfaction rates.

- It improves your competitiveness in the overall market by enabling your team to respond to sudden changes in the market.

When done right, dynamic pricing gives teams more control over their pricing strategy, allowing them to maximize every corner of their profit-generating market.

Cons

All that being said, there are some downfalls involved with using dynamic pricing. Depending on your market or specific organization, some of these drawbacks may be significant enough to deter you from moving forward with it.

- Some customers feel distrustful towards companies who use dynamic pricing. They can feel cheated if they have to pay a higher price than someone else and might question the true value of your offer if you raise or lower the price seemingly arbitrarily.

- Some dynamic pricing strategies generate profit on a bell curve; that is to say, at a certain point they begin losing profitability on an increasing scale. It’s important to pay attention to timing with dynamic pricing. Otherwise, it can become counterproductive.

- Without the right tools and training, dynamic pricing can be complicated and time-consuming.

- The process is prone to errors, even for those experienced and willing to learn.

How to Implement a Dynamic Pricing Strategy

If you think it could be a good fit for your team, the following steps will help you get started with a dynamic pricing strategy.

1. Determine Your Goal

One of the keys to successfully implementing a dynamic price strategy is to do so with intention.

What is your goal for dynamic pricing? Why are you implementing it, and why now? Are you hoping to sign on more new customers? Or increase your profit margin?

Answering these questions — and even deeper ones, like: Why does our company exist? What do our customers expect of us? How is our current pricing model serving or hurting us? — will help you determine the best dynamic pricing strategy to implement and how precisely to do it.

2. Calculate Your Value Metric

One way to combat potential customer mistrust that comes with dynamic pricing is to carefully set your value metric.

In other words, your sales and marketing time should collaborate to clearly identify and outline what it is you’re selling and how much it’s worth relative to the rest of the market offerings.

Determining your value metric helps explain any pricing changes you might make according to the rules of your dynamic pricing strategy.

3. Choose a Pricing Strategy & Rules

Once you’ve determined your goals and the way you’ll explain exactly what your customers are purchasing for the price, it’s time to find the specific strategy that’s most likely to help you meet your goals. Segmented pricing might work for some, while time-based might be more appropriate for others.

Remember that you can also set your pricing rules according to the more generic category “market conditions.” Just remember that your value metric will be even more important in this case — you need to be able to explain to your customers why you’re charging what you’re charging and why that cost changes at any given time.

Pricing rules need to stay consistent across time and conditions. Remember to also include any specifics about discounts or promotions you plan to offer.

4. Find the Right Tools to Implement Your Strategy

Fortunately for today’s sales teams, there are plenty of tools to help get your dynamic pricing strategy off the ground. Here are a few of our favorites:

- Omnia Retail

- PriceEdge

- Price2Spy

- Profasee

There are also many sales tools that are not specific to dynamic pricing that are capable of integrating and supporting a non-traditional pricing structure.

Tip: Looking to enhance your tech stack? Grab our free ebook below.

The Optimal Technology Stack for B2B Sales TeamsUsing data from the most successful business-scaling models, we designed a blueprint for the exact technology your business needs at each phase of growth.

The Optimal Technology Stack for B2B Sales TeamsUsing data from the most successful business-scaling models, we designed a blueprint for the exact technology your business needs at each phase of growth.

5. Test and Adjust

Finding a pricing structure that works can take time, and some trial and error. Don’t be afraid to A/B test different dynamic pricing structures in order to find the most profitable one for your team and market.

6. Be Upfront and Transparent

Teams that use dynamic pricing need to be constantly mindful of how their pricing decisions appear to the customer. When in doubt, be honest and transparent about when and why pricing will change. Be willing to hear customer concerns and even complaints about perceived unfairness. Your value metric will come in handy during these kinds of conversations.

Do you use dynamic pricing in your sales strategy? How does it work for your team? If you don’t use dynamic pricing, do you think there are opportunities to start? What model could work best for your team?

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox