Shareholder vs. Stakeholder: Why It Matter in Sales

Anya Vitko

Contents

- What Is a Shareholder?

- What Is a Stakeholder?

- Key Differences Between Shareholders and Stakeholders

- Historical Context and Evolution of Shareholder vs. Stakeholder Theories

- Practical Implications for Sales Professionals

- Balancing Shareholder and Stakeholder Interests

- Comparative Analysis Across Industries

- The Role of Sales Professionals in Stakeholder Management

- Future Trends in the Shareholder vs. Stakeholder Debate

- Conclusion

Nailing down shareholder vs. stakeholder differences is important for sales professionals to effectively move B2B customers through the sales funnel.

This article will provide definitions of both types of entities, introduce the shareholder theory vs. stakeholder theory, and explain why understanding the differences is important for sales professionals at every touch point in the sales pipeline.

Here’s what we’ll cover:

- What Is a Shareholder?

- What Is a Stakeholder?

- Key Differences Between Shareholders and Stakeholders

- Historical Context and Evolution of Shareholder vs. Stakeholder Theories

- Practical Implications for Sales Professionals

- Balancing Shareholder and Stakeholder Interests

- Comparative Analysis Across Industries

- The Role of Sales Professionals in Stakeholder Management

- Future Trends in the Shareholder vs. Stakeholder Debate

What Is a Shareholder?

A brief answer to the common question, “Are shareholders stakeholders?” is “no.”

A shareholder is any individual, company, or institution that owns at least one share of a company’s stock. In simple terms, a shareholder is a partial owner of the company.

There are two primary types of shareholders: common shareholders and preferred shareholders. Each type comes with different rights and benefits.

Common Shareholders

Common shareholders are individuals or entities that own common stock in a company. They typically enjoy the following rights:

- Voting Rights: They can vote on important company matters, such as electing board members or approving major business decisions, such as mergers and acquisitions.

- Dividends: Common shareholders may receive dividends, which are payments made by the company out of its profits. However, these dividends are not guaranteed and vary based on the company’s financial performance.

- Claim on Assets: In the event that the company goes bankrupt, common shareholders have a claim on the company’s assets, but only after preferred shareholders and other creditors are paid.

For example, if a company has a strong sales quarter and decides to pay out dividends, common shareholders may receive payments based on the number of shares they hold. However, if the company’s profits shrink, dividends may be reduced or withheld entirely.

Preferred Shareholders

Preferred shareholders are individuals or entities that own preferred stock. Unlike common shareholders, preferred shareholders enjoy a few distinct advantages:

- Priority in Assets: If a company goes bankrupt or is liquidated, preferred shareholders are paid before common shareholders, but still after creditors.

- Fixed Dividends: Preferred shareholders typically receive fixed dividend payments, which are stable compared to those received by common shareholders.

- Limited Voting Rights: Preferred shareholders usually don’t have voting rights or have limited voting rights on major company decisions.

To explain the concept of preferred shareholders better, let’s imagine a company that has mixed sales performance—while profits are down, preferred shareholders still receive their fixed dividend payments, whereas common shareholders may not receive any dividends at all due to decreased earnings.

What Is a Stakeholder?

A stakeholder is any individual, group, or organization that has an interest in or is affected by the activities and outcomes of a business. Stakeholders can be either directly involved in the company, such as employees, or indirectly influenced by its operations, like customers or suppliers.

Their stake in the business could be financial, emotional, or functional, depending on their role and connection to the company.

Types of Stakeholders

Stakeholders can be divided into two broad categories: internal and external.

1. Internal Stakeholders

Internal stakeholders are those who are directly involved within the organization and have a vested interest in its success. They include:

- Employees: Employees have a direct stake in the company’s success as they are the ones doing the legwork to keep the company running.

- Managers: Managers are key internal stakeholders responsible for overseeing the implementation of the company’s strategies, meeting various goals, and ensuring the team performs effectively.

- Owners/Shareholders: Company owners or shareholders provide the resources, capital, and support for their teams to succeed, and they expect strong returns on their investments.

2. External Stakeholders

External stakeholders are individuals or groups that are not directly part of the organization but are impacted by its operations and outcomes. These include:

- Customers: Customers are vital external stakeholders because they are the end users of products or services and directly influence business success through their buyer behavior.

- Suppliers/Partners: Suppliers, distributors, and business partners are external stakeholders that help businesses deliver products or services to the market.

- Community: The local community where a business operates is also considered a stakeholder because the company’s growth can affect job creation, community development, and corporate social responsibility initiatives.

Key Differences Between Shareholders and Stakeholders

The contrast between shareholders and stakeholders can be summarized in the table below:

Historical Context and Evolution of Shareholder vs. Stakeholder Theories

Often companies find themselves at the crossroads, needing to decide whether they will cater to their shareholders or stakeholders. This is because the interests of both groups often come into direct conflict. For example, while it may be beneficial for a company’s profits to exploit land for resources, doing so negatively affects local communities.

This is evident in the history of the interaction between Indigenous communities and the Canadian government. To give just one example, in the 1950s, provincial authorities built a dam on the English River to further their economic interests. This caused a series of events that degraded the local ecosystem and forced the displacement of the Asusubpeeschoseewagong Anishinabek (Grassy Narrows Indigenous people).

The shareholder theory dates back to the early 20th century, driven by the notion that the primary responsibility of a corporation is to maximize profits for its shareholders. This perspective was strongly advocated by economist Milton Friedman, who argued that the purpose of a business is to generate wealth for its owners or shareholders and that corporate managers are merely agents acting in the best interest of those shareholders.

The stakeholder theory emerged in response to the growing complexity of businesses and the recognition that other groups, beyond just shareholders, have an interest in a company’s success.

The stakeholder theory was formalized by R. Edward Freeman in the 1980s, who proposed that businesses have a responsibility not only to shareholders but to all parties affected by their operations, including employees, customers, suppliers, and the community at large.

Practical Implications for Sales Professionals

How does the conflict between these two theories affect sales teams?

Impact on Customer Relationships

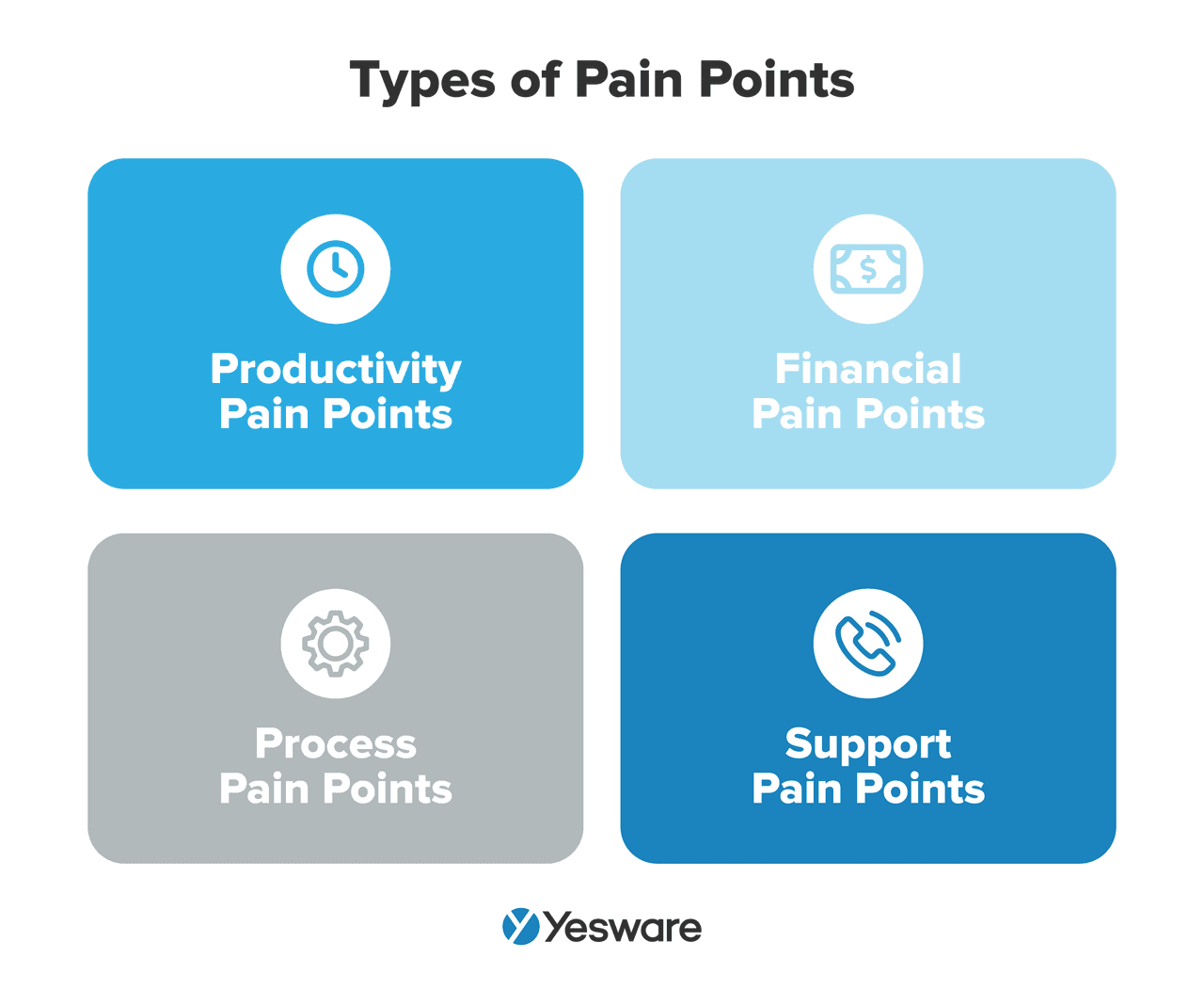

Focusing on stakeholders, especially customers, can significantly enhance customer loyalty. When sales professionals prioritize the customers’ pain points—whether through personalized solutions, ethical selling, or transparent communication—customers are more likely to return for repeat business and recommend the company to others.

For example, a stakeholder-focused sales approach might involve offering flexible pricing models, sales promotions, or product demos to address customer concerns rather than pushing for an immediate sale.

This focus on the long-term customer relationship rather than short-term gains fosters trust, which is a key driver of loyalty.

Pro Tip: Tools like Yesware’s email tracking can help sales professionals understand how stakeholders, including customers, are interacting with communications. By tracking email opens and link clicks, sales reps can tailor their follow-up strategies based on actual customer interest, improving their sales relationship building.

![]()

Influence on Sales Strategies

Understanding the needs and motivations of various stakeholders can refine a company’s lead capture, lead management, and sales engagement.

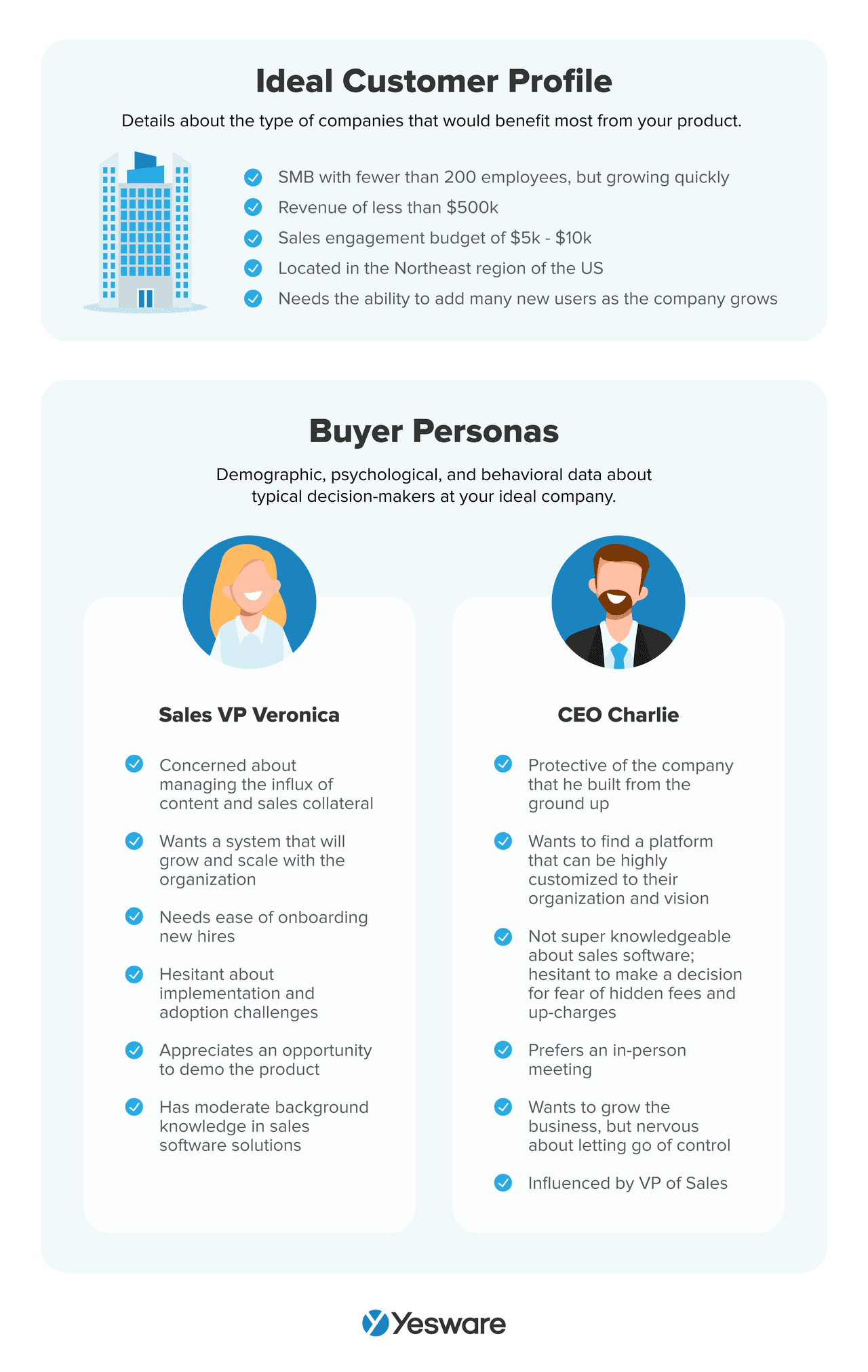

For instance, instead of only focusing on buyers with immediate purchasing power, sales professionals should also consider influencers within the company—like department heads, team members, or even end-users—who may not directly make the purchasing decision but can influence it.

A stakeholder-focused strategy would involve multi-channel engagement, ensuring that all parties involved in the purchasing process feel informed and valued. Sales professionals who engage with multiple decision-makers and consider their unique concerns are more likely to secure larger and longer-lasting deals.

For example, a software company offering CRM software could focus not only on the financial decision-maker (CFO) but also on the sales team, who would benefit from a user-friendly interface, and the IT team, who might be concerned with integration issues.

Tailoring the sales pitch to each of these stakeholders ensures a more holistic approach to closing the deal.

Pro Tip: Understanding the contrast between an ideal customer profile and buyer persona can help sales experts efficiently personalize their tactics.

Balancing Shareholder and Stakeholder Interests

The debate between shareholder theory and stakeholder theory has been a central topic in business for decades.

Many successful companies have found ways to balance the interests of both shareholders and stakeholders. For example, Salesforce has demonstrated that by focusing on customer success, community involvement, and environmental sustainability, they can also drive significant shareholder value. Their stakeholder-focused strategies have resulted in strong financial performance, brand loyalty, and market leadership.

Pro Tip: Adaptive leadership empowers sales managers to remain flexible and responsive to changing market conditions and customer demands.

Comparative Analysis Across Industries

While some industries are primarily driven by the need to maximize shareholder profits, others prioritize stakeholders such as customers, employees, or communities. For sales professionals, understanding these industry-specific approaches can help tailor sales strategies that align with the values and goals of potential clients.

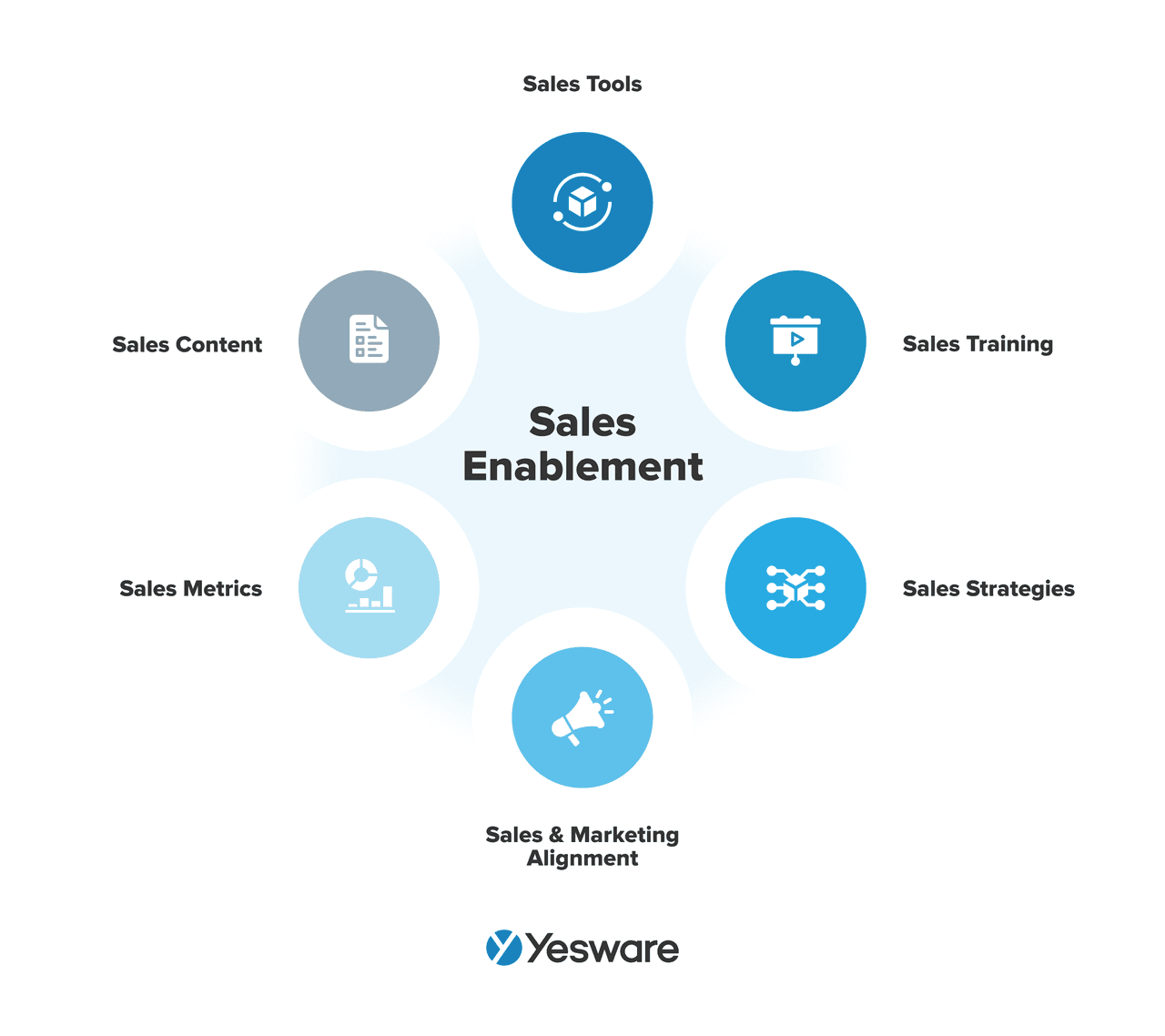

Pro Tip: Mock call is an effective sales enablement tactic that can help sales reps improve their communication skills and better prepare for real-world sales interactions.

1. Tech Industry

In the tech industry, companies often walk a fine line between focusing on shareholder returns and investing in innovation that benefits stakeholders such as employees, customers, and society at large.

Tech giants like Google and Apple frequently prioritize long-term innovation over immediate profits. These companies invest heavily in research and development (R&D) to stay competitive and push technological boundaries, which benefits customers and employees by providing cutting-edge products and job opportunities.

For sales professionals working in the sales tech industry, it’s important to highlight how their products or services align with a company’s innovation goals. Rather than focusing solely on profit-maximizing strategies, sales teams should emphasize how the solutions they offer can support a company’s long-term vision, enhance customer satisfaction, and contribute to employee productivity.

2. Healthcare

The healthcare industry places a strong emphasis on stakeholder priorities, particularly when it comes to patient care. While profitability is still a major concern, healthcare providers must balance shareholder expectations with ethical considerations around patient well-being, safety, and access to care.

Sales professionals in healthcare must understand that stakeholder concerns—such as improving patient outcomes—are central to decision-making. When pitching products, it’s important to frame them in terms of how they enhance patient care, ensure compliance with regulations, and align with the provider’s ethical standards.

3. Finance

When it comes down to banks, investment firms, and insurance companies, the focus tends to skew heavily toward maximizing shareholder profits. While stakeholder concerns such as regulatory compliance and customer service are important, the primary objective remains increasing shareholder value.

For sales professionals working in the finance sector, it is important to demonstrate how products and services can directly impact financial performance. This means offering solutions that drive revenue growth, improve efficiency, or cut costs. Understanding the bottom line is key when selling to financial institutions, and aligning the sales pitch with profit-maximizing goals will resonate with decision-makers.

The Role of Sales Professionals in Stakeholder Management

Sales professionals should conduct a thorough analysis to identify each stakeholder’s role and influence. This includes understanding who has decision-making power, who can influence the purchase, and who will ultimately use the product.

Once stakeholders are identified, the next step is to build and maintain relationships. Stakeholder engagement is not a one-time effort; it requires ongoing communication and rapport-building to ensure that stakeholders remain supportive of the sale.

Every stakeholder group has its priorities, and sales professionals need to tailor their messages accordingly. For example, the C-suite may focus on the financial impact of a purchase, while end-users might care more about ease of use or functionality.

Pro Tip: Developing strong sales manager skills, such as data analysis, team training, and team motivation, is essential for driving a high-performing sales team.

Sales Management Training GuideEverything you need to know to be a successful sales manager – backed by data and real-world experiences.

Sales Management Training GuideEverything you need to know to be a successful sales manager – backed by data and real-world experiences.

Future Trends in the Shareholder vs. Stakeholder Debate

As businesses increasingly face pressure to address environmental concerns, the focus is shifting toward long-term value creation that benefits all stakeholders, not just shareholders.

Companies are being held accountable for their environmental impact, with stakeholders—including customers, employees, and communities—demanding more sustainable practices.

Issues of diversity, equity, and inclusion are also reshaping corporate priorities. Sales professionals often find themselves engaging with stakeholders who care about how a company addresses social justice issues, affecting not only purchasing decisions but also brand loyalty.

Conclusion

As companies continue to balance shareholder vs. stakeholder interests, sales professionals must adapt by identifying key stakeholders, building strong relationships, and communicating value in a way that resonates with diverse groups.

By leveraging sales engagement tools like Yesware, sales teams can manage stakeholder relationships more effectively. Sign up to try Yesware for free.

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox