Total Addressable Market (TAM): How to Calculate and Utilize

Casey O'Connor

In sales, the total addressable market (TAM) refers to the maximum number of customers — or, in some cases, the maximum amount of revenue — an organization could possibly acquire if they were to capture 100% of market share.

Although in most cases it’s quite unrealistic to expect to reach all of the total addressable market, the metric is useful in determining the maximum possible revenue and/or profit opportunity for a product, region, or market, which in turn helps prioritize and allocate funding or resources toward it.

In this article, we’ll go over everything you need to know about the total addressable market, including what exactly it is, how and why to calculate it, and how TAM compares to its counterparts, SAM and SOM.

Here’s what we’ll cover:

What Is Total Addressable Market (TAM)?

The total addressable market (also sometimes called total available market or, more often, “TAM”) is a way of measuring a market’s potential. It indicates the maximum amount of revenue that could potentially be generated from a particular product, service, geographical area, or target market.

TAM can also be measured in terms of the maximum number of customers a sales team could potentially close if no other obstacles or challenges existed in the sales process.  Put another way, TAM is the measure of the total market demand for a particular product or service.

Put another way, TAM is the measure of the total market demand for a particular product or service.

TAM is more theoretical than tangible, as even the most skilled marketing and sales teams are unable to win every possible buyer in their market. The TAM metric intentionally discounts all potential challenges with talent, processes, or funding, and assumes a frictionless sales process, with access to a pool full of enthusiastic and well-funded buyers. Neither of these scenarios is realistic.

That being said, TAM is anything but useless. Calculating TAM, even though it’s an “idealized” figure, is actually very important for sales forecasting, and for creating an objective estimate of a particular market’s potential. This helps determine how many resources a sales and marketing team should devote to it.

The accompanying SAM and SOM metrics (more on these terms later in this article) ultimately help balance out the unrealistic nature of TAM, and the three together provide a more complete picture of a particular market’s overall potential.

How to Calculate TAM

In general terms, the formula for calculating the TAM for a market is to multiply the total number of accounts in your market by the annual contract value (ACV).  With that in mind, there are three primary methods for calculating TAM: top-down, bottom-up, and a value theory approach.

With that in mind, there are three primary methods for calculating TAM: top-down, bottom-up, and a value theory approach.

Top-Down Approach

The top-down approach to calculating TAM starts with a big-picture view of the very top of the entirety of a market’s economy.

The process then applies the appropriate demographic, geographic, and economic filters to the group until all irrelevant segments are removed, and the only subset left is the TAM.  A top-down approach requires access to (and confidence in) accurate industry data. Analytics centers like Forrester and Gartner can provide market reports to help assist in this process.

A top-down approach requires access to (and confidence in) accurate industry data. Analytics centers like Forrester and Gartner can provide market reports to help assist in this process.

Some teams even go a step further and opt to hire market research consulting firms to help them navigate a top-down approach.

Bottom-Up Approach

When teams use a bottom-up approach, they start with data from a small subset of a market and use it to make predictions about the potential for that market as a whole.  Sales teams who use the bottom-up method to calculate TAM choose it because it’s based on real, existing market and pricing data. Sales teams can collect this data from primary sources (like customer surveys) and secondary research from third-party sources like Forrester, Gartner, IDC, etc. (e.g., news reports, press releases, company filings).

Sales teams who use the bottom-up method to calculate TAM choose it because it’s based on real, existing market and pricing data. Sales teams can collect this data from primary sources (like customer surveys) and secondary research from third-party sources like Forrester, Gartner, IDC, etc. (e.g., news reports, press releases, company filings).

That being said, a bottom-up approach can sometimes be surprisingly off-base. That’s because a bottom-up TAM approach extrapolates market predictions from a very small subset of data points. If those data sets are inaccurate for any reason, the TAM calculation will be too.

Value Theory

A value theory approach to calculating TAM is based on how much value customers gain from your offer, and how much they’d be willing to pay according to that value.

This approach is commonly used for scenarios in which a product is improved or updated, and the sales team wants to determine how much more they could charge for the new iteration. In this case, they could use the value theory approach to define how much value the consumer gets from the new offer, and how much more they would pay accordingly.

It’s also beneficial when teams are planning to introduce new products, or when they’re testing a market for cross-selling new products to existing customers.

Market Subsets: TAM vs. SAM vs. SOM

Likely due to its tongue-twister acronym name, many people misremember the subtle differences between TAM, SAM, and SOM.  Here’s a closer look at each of the three terms, and how they relate and compare to one another.

Here’s a closer look at each of the three terms, and how they relate and compare to one another.

TAM

TAM, as we’ve discussed, represents the total available market for a particular product or service. It’s usually defined in terms of total potential revenue, but can also be expressed in terms of number of customers.

Let’s look at TAM vs. SAM. vs. SOM in terms of a simplified example.

Imagine you’re hoping to open an Italian restaurant in your city.

The Total Available Market for this offer is all restaurant-goers in your city. (Remember, this can also be defined in terms of revenue — total revenue for all restaurants in your city).

SAM

The Serviceable Available Market, more commonly known as SAM, refers to the subset of the TAM that your team is hoping to target.

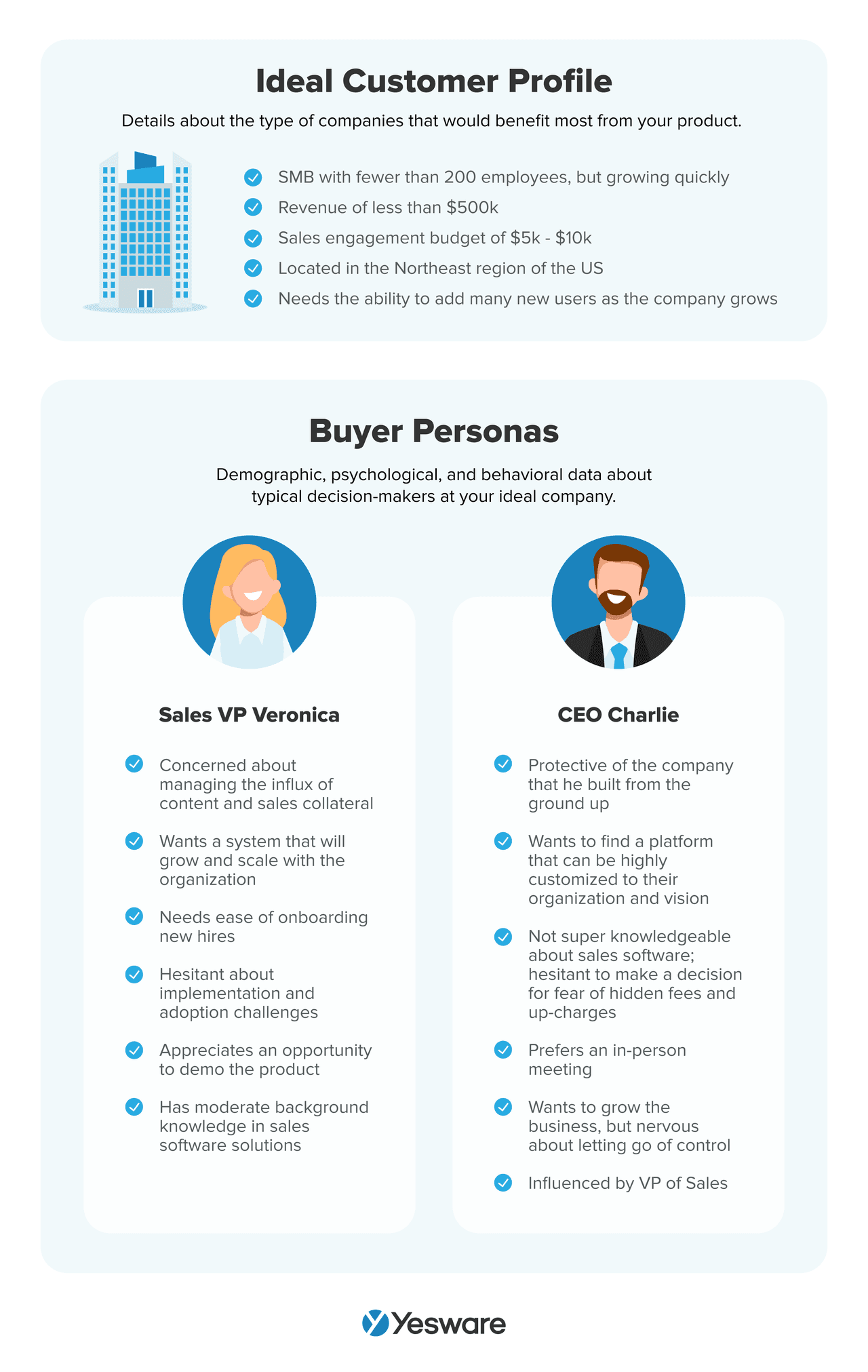

SAM uses filters like demographics, geography, regulations, buyer preferences, etc. to segment the market and target their ideal customer profiles (ICP).  SAM can also be defined according to a company’s particular resources and/or limitations.

SAM can also be defined according to a company’s particular resources and/or limitations.

In our restaurant example, the SAM would be the percentage of restaurant-goers who would be willing to eat at an Italian restaurant in your city.

Remember, it’s unrealistic for your team to successfully reach the full TAM; SAM (and SOM, in the next section) account for the natural buyer and external factors that define your actual, realistic market.

SOM

The most narrow of the three metrics is SOM, or the Serviceable Obtainable Market. This represents the percentage of SAM that can be realistically achieved in the short term.

SOM takes into account your business’s competitors, as well as other external market factors and trends, and internal resource concerns.

When calculating SOM, historical sales performance and sales forecasts can both give a good insight into what’s realistic and how to set achievable SMART goals.  To take this back to our restaurant example, the SOM would be the number of people who are in the mood to dine out on Italian food, who also have the financial and logistical means to get to the restaurant. This number will ultimately be much smaller than the original TAM (all restaurant goers).

To take this back to our restaurant example, the SOM would be the number of people who are in the mood to dine out on Italian food, who also have the financial and logistical means to get to the restaurant. This number will ultimately be much smaller than the original TAM (all restaurant goers).

Tip: Improve your sales strategy and process with the latest data findings in the ebook below.

Sales Engagement Data Trends from 3+ Million Sales ActivitiesLooking at millions of tracked email activity over the past few years, this ebook is filled with our top studies and findings to help sales teams accelerate results.

Sales Engagement Data Trends from 3+ Million Sales ActivitiesLooking at millions of tracked email activity over the past few years, this ebook is filled with our top studies and findings to help sales teams accelerate results.

Why Should I Calculate TAM?

Although most people in sales understand that the total addressable market is an “unrealistic” figure, it’s nonetheless an incredibly important metric for a number of reasons.

Strategy Alignment

It’s important for sales and marketing teams to have a thorough and common understanding of a market’s potential as they design their strategies. Calculating TAM helps marketers and sales reps understand the big-picture scope of what’s possible, so they can create a strong and realistic roadmap to success.

Product Launch

Calculating TAM is a critical step in the go-to-market strategy for a new product. It gives insight to sales and marketing about product-market fit for new products, as well as new customer segments and cross-selling existing products to existing customers.

Pricing

Every time you develop a new pricing structure, or make changes to an existing one, you should calculate TAM to determine the revenue potential at the new price. This is an important piece of financial modeling that some teams overlook.

Marketing Expansion Planning

TAM also becomes important when your team is planning to execute market expansion. TAM helps teams analyze the revenue potential for specific products, customer segments, and/or territories.

Investment Decisions

Investors want to know that sales teams are calculating TAM, because it shows commitment to accuracy, thorough planning, and careful strategization.

Risk Management

Calculating TAM helps mitigate risk by helping marketing and sales teams eliminate markets or products with weak or otherwise unappealing TAM. When sales teams calculate TAM, it helps them weigh the pros, cons, and potential risks of attempting to launch a new product, target a new market, or expand into a new territory.

Yesware Can Help

Yesware’s suite of tools helps sales reps and marketers get into the minds of their market, so they never miss out on intel.

With real-time data available directly in your inbox, you can have immediate, up-to-the-minute data about trends and behavior in your market.

Our data enrichment capabilities are thorough and impeccably accurate, giving you the most updated B2B data available.

And with seamless integration with a wide variety of sales tools, including Gmail, Outlook, Salesforce, and more, Yesware improves and enhances every piece of your tech stack.

Have you calculated the total addressable market with your team? How has TAM helped you strategize?

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox